Bronchial asthma sufferers have many drug choices, however many sufferers discover these decisions both inconvenient or insufficient for extreme circumstances of the power respiratory situation. Upstream Bio is pursuing a validated immunological goal with a drug it contends affords dosing and efficacy benefits over a commercialized bronchial asthma remedy from AstraZeneca and Amgen, and the biotech now has $225 million in IPO money to assist construct its case with medical information.

Traders are persuaded by Upstream’s ambition, and their curiosity within the biotech’s new inventory enabled the corporate to spice up the deal measurement. After setting preliminary IPO phrases of 12.5 million shares within the vary of $15 to $17 every, which might have raised $200 million on the pricing midpoint, the Waltham, Massachusetts-based biotech on Thursday ended up providing 15 million shares on the prime of the focused worth vary. Upstream’s shares now commerce on the Nasdaq beneath the inventory image “UPB.” On Friday, Upstream’s first day on the general public markets, the corporate’s inventory worth closed at $22, up 29.4% from the IPO worth.

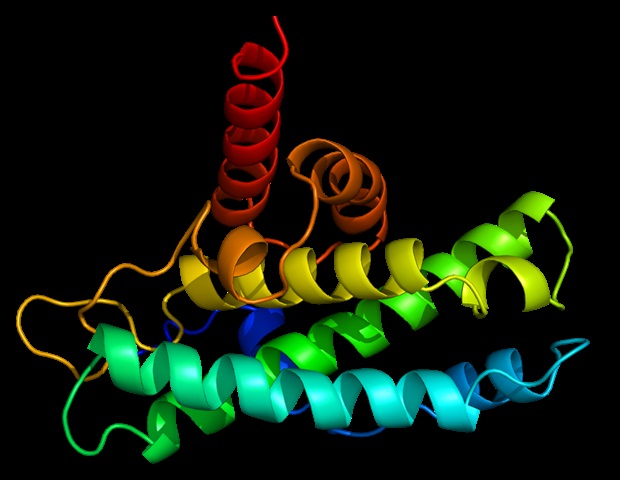

Extreme bronchial asthma is outlined as illness that’s uncontrolled regardless of therapy with high-dose inhaled corticosteroids. It can be bronchial asthma that requires high-dosed inhaled corticosteroids to stop signs from turning into uncontrolled. Biologic medicine provide sufferers an alternate therapy possibility for circumstances of uncontrolled bronchial asthma. Upstream’s lead drug is verekitug, a monoclonal antibody designed to dam thymic stromal lymphopoietin, or TSLP. This signaling protein performs a task in immunological problems and it’s upstream of a number of signaling cascades concerned in lots of immune-mediated illnesses, the corporate stated in its IPO submitting.

Of the six biologic medicine presently accredited for extreme bronchial asthma, solely the AstraZeneca and Amgen product Tezspire addresses TSLP. However whereas Tezspire blocks the TSLP ligand, Upstream’s drug blocks the TSLP receptor. Upstream contends its method might provide higher management of bronchial asthma signs. It additionally affords potential for much less frequent dosing. The corporate is testing dosing each 12 weeks and each 24 weeks — a a lot decrease dosing burden in comparison with as soon as month-to-month injections of Tezspire.

“We consider that by lowering the frequency of dosing we will enhance affected person compliance with biologic remedies for extreme bronchial asthma,” Upstream stated in its IPO submitting. “Moreover, a much less frequent dose interval could enchantment to sufferers that aren’t happy with their present therapy plan or are unwilling to take present biologics as a result of therapy burden that comes with frequent dosing.”

In Section 1b testing, Upstream reported its drug led to “fast and full TSLP receptor occupancy.” Outcomes additionally confirmed reductions in organic indicators of bronchial asthma that had been sustained for as much as 24 weeks after the final dose. Tezspire, which gained FDA approval in 2021, was not a part of this examine as a comparator. However Upstream stated verekitug’s outcomes present it was about 300-fold stronger than the AstraZeneca and Amgen product based mostly on printed information for that drug. The Section 1b outcomes had been offered in Might in the course of the American Thoracic Society Worldwide Convention.

A Section 2 take a look at of verekitug in extreme bronchial asthma started this previous March; preliminary information are anticipated within the second half of 2026. Upstream’s method to blocking TSLP has potential in different immunological situations. A Section 2 take a look at in power rhinosinusitis with nasal polyps is anticipated to yield information within the second half of 2025. A separate mid-stage trial in power obstructive pulmonary illness (COPD) is anticipated to start within the second half of subsequent yr.

Verekitug was found by Astellas Pharma, which superior the drug candidate to Section 1 testing. In 2021, months after Upstream fashioned, the younger firm acquired the Astellas asset for $81.1 million, in keeping with the submitting. There aren’t any future funds owed to the Japanese pharma firm.

Upstream had raised $400 million from traders previous to the IPO, in keeping with the submitting. The corporate’s most up-to-date financing was a $150 million Collection B spherical introduced in June and led by Enavate Sciences and Venrock Healthcare Capital Companions. Orbimed is Upstream’s largest shareholder with a 9.9% post-IPO stake, the submitting exhibits. As of the tip of June, the corporate reported its money place was $235.8 million.

Now that Upstream is public, the corporate plans to spend $150 million to proceed the continuing Section 2 take a look at of its lead program in extreme bronchial asthma and advance it into Section 3. About $40 million is budgeted for finishing a Section 2 take a look at of the molecule in power rhinosinusitis with nasal polyps and beginning a Section 3 take a look at on this indication. One other $50 million is put aside for prices related to verekitug drug substance, together with manufacturing. The corporate stated it expects its capital will probably be enough to fund operations by way of mid-2027.

CAMP4 Therapeutics Corrals $75M for Trials With a New Sort of RNA Remedy

CAMP4 Therapeutics, an organization named for the ultimate camp earlier than the summit of Mount Everest, has $75 million in IPO money to proceed growth of remedies for haploinsufficiencies, problems by which dysfunction in a single copy of a gene results in abnormally low ranges of a key protein. The Cambridge, Massachusetts-based biotech goals to deal with illness by concentrating on regulatory RNA, or regRNA, a sort of RNA that regulates gene expression.

The CAMP4 medicine are antisense oligonucleotides that bind to regRNA and get it to dial up gene expression. In a 2021 interview, CAMP4 CEO Josh Mandel-Brehm in contrast the method to utilizing a rheostat to regulate {an electrical} present. The corporate’s medicine, known as RNA actuators, amplify gene expression in a controllable manner, he stated. Metabolic and central nervous system haploinsufficiencies are the corporate’s preliminary areas of focus.

Lead program CMP-CPS-001 is in growth for urea cycle problems, inherited metabolic illnesses that render the physique unable to correctly convert ammonia into urea. CAMP4’s drug is designed to amplify expression of an enzyme that catalyzes step one of the urea cycle. In preclinical analysis, outcomes confirmed a decreasing of ammonia ranges to regular ranges. A Section 1 take a look at is underway in wholesome volunteers. Knowledge from the one dose ascending portion of the trial are anticipated within the first quarter of 2025; the a number of ascending dose portion is anticipated to have information within the second half of subsequent yr. The following program within the pipeline is a preclinical therapy for SYNGAP1-related problems, neurodevelopmental situations brought on by pathogenic variants within the SYNGAP1 gene. This haploinsufficiency results in SYNGAP ranges as much as 50% under the traditional vary.

CAMP4 had raised $183.3 million previous to its IPO. The corporate’s most up-to-date financing was a $100 million Collection B spherical in 2022 led by Enavate Sciences. Enavate is CAMP4’s largest shareholder with a 13.7% post-IPO stake, adopted by 5AM Ventures with an 11.4% stake, the submitting exhibits.

As of the tip of the second quarter of this yr, CAMP4 reported a $12.6 million money place. With the IPO proceeds, the corporate plans to spend $26 million to finish the Section 1 take a look at of its lead drug candidate for urea cycle problems. About $18 million is put aside for persevering with preclinical growth of the SYNGAP1 program. One other $10 million is budgeted for increasing CAMP4’s platform expertise and for growth of different packages within the preclinical and discovery levels.

CAMP4 was in a position to increase the cash it wants for its plans, however it needed to considerably reduce its IPO worth to take action. In preliminary IPO phrases set earlier this week, CAMP4 deliberate to supply 5 million shares within the vary of $14 and $16 every, which might have raised $75 million on the pricing midpoint. CAMP4 reached its $75 million purpose by providing 6.82 million shares priced at $11 apiece. These shares are buying and selling on the Nasdaq beneath the inventory image “CAMP.”

CeriBell Upsizes IPO to Assist a Commercialized EEG Tech Using AI

Medical expertise firm CeriBell raised $180.3 million to bolster commercialization efforts for its FDA-cleared electroencephalography (EEG) expertise. The Ceribell System makes use of synthetic intelligence to help within the detection and administration of seizures. The {hardware} is a disposable headband and a pocket-sized recorder that captures and wirelessly transmits EEG alerts. An AI-powered seizure detection algorithm constantly displays the affected person’s EEG sign to detect seizures.

Ceribell System, which is utilized in intensive care items and emergency departments, commercially launched in 2018. Sunnyvale, California-based CeriBell has two sources of recurring income: gross sales of the disposable headbands and a month-to-month subscription charge charged to the hospital clients that use the corporate’s expertise. In 2023, CeriBell reported $45.2 million in whole income, a 74% enhance in comparison with the prior yr. Within the first half of this yr, income was $29.7 million, a forty five% enhance in comparison with the identical interval in 2023. As of the tip of September, CeriBell reported its money place was $14 million. With the IPO proceeds, CeriBell plans to make use of $90 million for gross sales and advertising and marketing and $20 million for analysis and product growth.

CeriBell was in a position to upsize its IPO. In preliminary monetary phrases set earlier this week, the corporate estimated it might increase $88.9 million. The corporate revised these phrases early Thursday, aiming to supply 6.7 million shares within the vary of $16 to $17 every, which might have raised $174.9 million on the pricing midpoint. When the corporate lastly priced its IPO late Thursday, it ended up providing 10.6 million shares priced on the high quality. CeriBell’s shares commerce on the Nasdaq beneath the inventory image “CBLL.”

Picture: Jackie Niam, Getty Photos