Six months after launching with a mega-round of financing, Seaport Therapeutics has raised $225 million extra to advance a lead drug candidate that might overcome some limitations of presently obtainable therapies for despair.

Seaport’s platform know-how, referred to as Glyph, designs oral medication that leverage the lymphatic system to ship the medication in a approach that makes extra of the lively pharmaceutical ingredient obtainable within the physique to confer its therapeutic impact. The Boston-based firm additionally says its medication scale back problems equivalent to elevated liver enzyme ranges, an indication of drug toxicity that may restrict the usage of some molecules.

Lead Seaport program SPT-300 is a prodrug, a compound that converts contained in the physique into the lively drug allopregnanolone. This neurosteroid modulates the GABA-A receptor to spark results on the central nervous system. Seaport is advancing the drug into Part 2b testing as a possible remedy for main depressive dysfunction with or with out anxious misery. Seaport says the brand new capital will go towards advancing its pipeline by necessary scientific milestones. The corporate additionally plans to additional advance the capabilities of its Glyph know-how platform.

Seaport was spun out of PureTech Well being, an organization that types startups round platform applied sciences. In April, Seaport launched, revealing its science, its lead drug candidate, and $100 million in funding. That Sequence A spherical was led by Arch Enterprise Companions and Sofinnova Investments. Basic Atlantic led Seaport’s new Sequence B financing. Different members within the newest spherical included T. Rowe Worth Associates, Foresite Capital, Invus, Goldman Sachs Options, CPP Investments, and different unnamed new buyers. Founding buyers Arch and Sofinnova additionally joined the spherical, as did Third Rock Ventures and PureTech Well being.

Seaport is a part of a bevy of life science firms which have secured new capital. Right here’s a recap of latest biotech financing information:

—Radiopharmaceuticals developer Alpha-9 Oncology closed a $175 million Sequence C spherical to assist its pipeline, together with A9-3202, which started a Part 1 check earlier this 12 months in superior melanoma. Lightspeed Enterprise Companions and Ascenta Capital led Alpha-9’s new financing.

—AvenCell Therapeutics has $112 million in Sequence B funding to proceed Part 1/2 testing of AVC-101, a CAR T-therapy that may be switched “on” or “off” to deal with security and efficacy challenges of presently obtainable cell therapies, that are at all times “on.” AvenCell was shaped in 2021 by Intellia Therapeutics and Cellex Cell Professionals. The corporate’s newest financing was led by Novo Holdings.

—Tolerance Bio launched with $17.2 million to assist growth of allogeneic stem cell-based cell therapies. These therapies are supposed to protect the thymus, the organ that trains T cells to defend in opposition to threats and protect autoimmunity. The Philadelphia-based biotech’s seed financing, led by Columbus Enterprise Companions, might be used to advance towards the clinic with potential therapies for immune illnesses.

—March Biosciences, spun out of the Middle for Cell and Gene Remedy, unveiled $28.4 million in Sequence A financing. Lead program MB-105 is a CAR T-therapy designed to focus on CD5, a protein expressed on cancerous T cells. A Part 1 check is underway enrolling sufferers with refractory T cell lymphoma and leukemia. Mission BioCapital and 4BIO Capital led March Bio’s financing.

—Be Biopharma closed $82 million in financing because the cell remedy developer strikes into the clinic with BE-101, a possible remedy for hemophilia B. The biotech’s therapies are made by engineering B cells to supply therapeutic proteins. Be Bio final raised cash in 2022, a Sequence B financing that totaled $130 million.

—Terray Therapeutics, a biotech that makes use of generative AI to find and develop small molecule medication, unveiled a $120 million Sequence B financing. Los Angeles-based Terray will use the capital to advance inside packages into scientific trials for indications that weren’t disclosed. The financing was led by new investor Bedford Ridge Capital and earlier investor NVenture, the funding arm of NVIDIA. Right here’s extra about Terray and its know-how platform, tNova, which it unveiled in 2022.

—Genetic medicines have been troublesome to ship to the kidney. Judo Bio is creating oligonucleotide medication that focus on a specific receptor to succeed in the organ, and the Cambridge-based startup unveiled $100 million in seed and Sequence A financing to advance its analysis towards the clinic. The Sequence A spherical was co-led by Atlas Enterprise, TCG, and Droia Enterprise.

—Purespring Therapeutics, a developer of gene therapies for kidney illness, raised £80 million (about $105 million). The London-based firm’s therapies goal the podocyte, a particular cell implicated in 60% of renal illnesses. Proceeds might be used to advance lead program PS-002 right into a Part 1/2 scientific trial for immunoglobulin A nephropathy, a uncommon illness presently handled with chronically administered therapies. Sofinnova Companions led Purespring’s Sequence B financing.

—Synthetic intelligence biotech firm Basecamp Analysis revealed a $60 million Sequence B financing to scale its assortment of knowledge and strengthen its AI capabilities. The London-based startup additionally introduced a multi-year collaboration with David Liu of the Broad Institute of MIT and Harvard. Basecamp mentioned this partnership will analysis new approaches to programmable genetic medicines with potential purposes in a spread of illnesses.

—Metropolis Therapeutics launched with $135 million to develop next-generation RNA interference (RNAi) medication. The corporate says its engineering platform can design therapies in smaller sizes which have novel mobile mechanisms and improved efficiency, effectivity, and specificity. The Cambridge-based biotech, co-founded by scientists concerned within the first era of RNAi therapies, expects to enter the clinic by the top of 2025. Arch Enterprise Companions led Metropolis’s Sequence A spherical.

—Decision Therapeutics raised £63.5 million to advance to Part 1/2 testing with RTX001, an engineered autologous macrophage cell remedy that might provide anti-fibrotic and anti inflammatory results in sufferers with end-stage liver illness. The corporate, which maintains operations in London and Edinburgh, Scotland, mentioned this trial might be carried out in the UK and Spain. Syncona led the Sequence B spherical, which can even assist analysis in different inflammatory fibrotic circumstances equivalent to graft-versus-host illness and lung fibrosis.

—Triveni Bio raised $152 million to assist a pipeline whose most superior program, TRIV-573, is a bispecific antibody that blocks two targets related to atopic dermatitis. The Watertown, Massachusetts-based biotech goals to file an investigational new drug software for this program within the first quarter of 2025. Triveni launched final 12 months supported by a $92 million Sequence A financing. Goldman Sachs Options led the corporate’s Sequence B.

—Kailera Therapeutics launched with $400 million to assist its GLP-1 and GIP receptor agonist medication for metabolic indications, together with weight problems. Kailera’s 4 packages have been licensed from China-based Jiangsu Hengrui Prescription drugs. The Sequence A financing was co-led by Atlas Enterprise, Bain Capital Life Sciences, and RTW Investments.

—Radiopharmaceutical developer Aktis Oncology unveiled $175 million in financing to assist growth of a pipeline led by AKY-1189, an alpha radiotherapy that targets Nectin-4, a tumor-associated antigen present in a spread of strong tumors. The Sequence B spherical was led by RA Capital Administration and co-led by RTW Investments and Janus Henderson Buyers. Boston-based Aktis emerged from stealth in 2021 backed by $72 million in Sequence A financing.

—Genespire raised €46.6 million (about $52 million) to advance to Part 1/2 testing with GENE202, an in vivo gene remedy in growth for methylmalonic acidemia, a uncommon inherited dysfunction that impairs the metabolism of sure amino acids and fat. The Milan, Italy-based startup’s Sequence B spherical was co-led by Sofinnova Companions, XGEN Enterprise, and CDP Enterprise Capital.

—Vaccines developer Vicebio unveiled $100 million in financing because it begins a Part 1 check of VXB-241, a bivalent vaccine designed to deal with each respiratory syncytial virus (RSV) )and human metapneumovirus (hMPV). Knowledge are anticipated in mid-2025. The following Vicebio program is VXB-251, a trivalent vaccine for RSV, hMPV, and parainfluenza virus 3. The London-based firm’s Sequence B spherical was led by TCGX.

—GC Therapeutics launched with $65 million in financing. The biotech’s next-generation cell therapies come from a platform know-how referred to as TFome, which packages induced pluripotent stem cells. GC’s preliminary therapeutic areas of focus embrace gastrointestinal, neurological, and immunological illnesses. Cormorant Asset Administration led Cambridge, Massachusetts-based biotech’s Sequence A financing.

—Neuroscience startup Nura Bio prolonged its Sequence A financing by $68 million to proceed to Part 2 testing with an oral small molecule designed to dam SARM1, an enzyme related to axonal harm. It faces potential competitors from Eli Lilly, which is in early scientific growth with a drug that goes after the identical goal. Nura Bio’s founding investor The Column Group led the startup’s new financing.

—F2G raised $100 million for olorofim, which is in late-stage growth to deal with aspergillosis and different invasive fungal infections. Olorofim is from a novel class of antifungal brokers that work by inhibiting the pyrimidine synthesis pathway. The money will allow the Manchester, U.Okay.-based firm to finish late-stage scientific growth, submit regulatory purposes, and put together for U.S. commercialization of the drug. The brand new financing was led by new investor AMR Motion Fund and co-led by ICG.

—T cell engagers first reached sufferers as most cancers therapies. Candid Therapeutics goals to convey such medication to autoimmune issues, and its efforts are backed by greater than $370 million in financing. Candid’s drug candidates got here from buying and merging two biotechs, Vignette Bio and TRC 2004. The Candid pipeline consists of two T cell engagers for most cancers now being repositioned for growth in autoimmune illnesses. These therapies are designed to selectively deplete B cells that drive illness.

—Startup creator Flagship Pioneering unveiled its latest firm, Mirai Bio. Mirai’s platform know-how is utilized to the event of genetic medicines for the corporate’s companions working throughout a spread of therapeutic areas and therapeutic modalities. It says its platform know-how unlocks supply of a drug to any tissue and cell kind, optimize design of the drug cargo, and facilitates manufacturing. Like different startups that come from Flagship, Mirai is backed by the customary $50 million in financing.

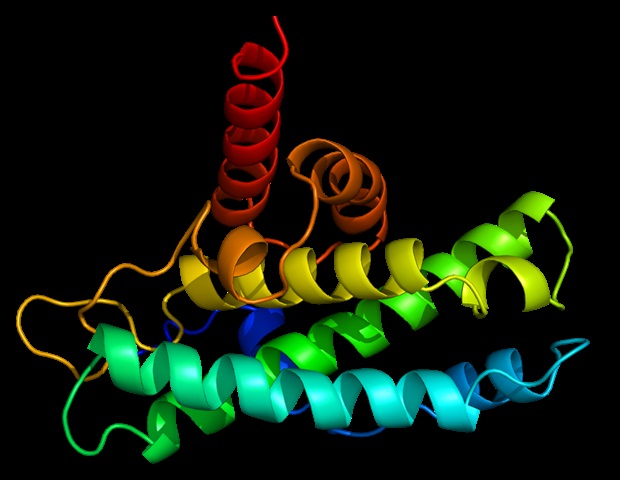

—Superluminal Medicines, an organization creating small molecule medication that focus on elusive G protein-coupled receptors (GPCRs), closed $120 million in financing. The Boston-based startup says its medication goal membrane receptors that mediate cell signaling and response processes basic to human physiology. These small molecule come from a generative biology and chemistry platform know-how. The brand new capital might be used to advance towards the clinic in undisclosed indications. RA Capital Administration led the Sequence A financing.

—Using sturdy investor curiosity in metabolic dysfunction medication, OrsoBio closed $67 million to advance a pipeline that features packages for kind 2 diabetes, weight problems, and the fatty liver illness MASH. The Menlo Park, California-based startup’s medication tackle pathways related to vitality metabolism. The Sequence B spherical, led by Ascenta Capital and Woodline Companions, comes lower than a 12 months after the corporate unveiled $60 million in Sequence A financing.

Picture by Flickr consumer Massachusetts Workplace of Journey & Tourism through a Inventive Commons license